الأثنين, مايو 23rd 2022

While the gap between rich and poor has been steadily widening in many countries, the situation in Switzerland has remained stable over the past decades, according to recent statistics. Yet while income distribution in the Alpine nation is relatively egalitarian, wealth is more concentrated in the hands of the rich. Pauline Turuban of SwissInfo investigates. Reprinted with permission.

The highest concentration of wealth in Switzerland is in Zug, pictured above.

What level of social inequality is acceptable? When does this become a risk for society? For years politicians, economists and sociologists around the world have been asking these same questions – without any clear answers.

In Switzerland, the political left has repeatedly attempted to impose higher taxes on the rich, which have always been rejected at the ballot box. The last was in September 2021, when voters turned down the “99% initiative,” which called for the introduction of a tax on gains from dividends, shares and rents.

To provide some data to help the ongoing debate, the Swiss Institute for Economic Policy (IWP) at the University of Lucerne recently published a database on distribution of income – both from work or capital – in Switzerland over the past century. The figures only represent part of overall wealth, as they do not include owned assets (more on this point later), but they do provide certain useful insights.

Remarkable stability

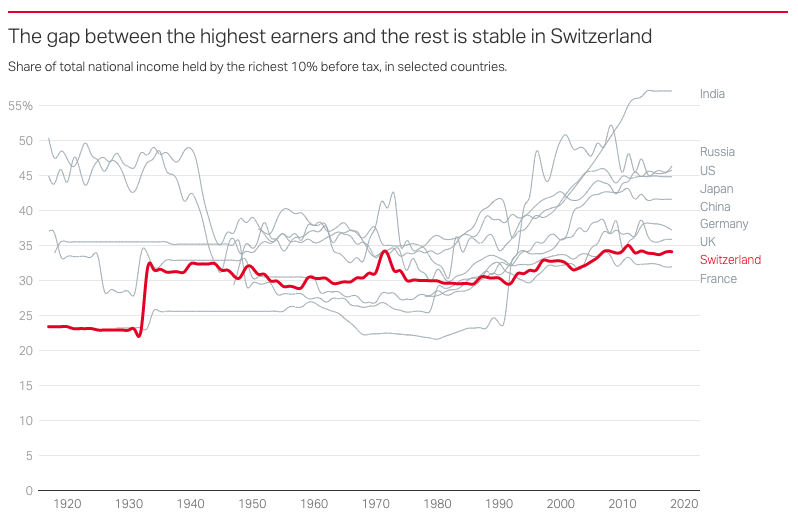

Among its main conclusions, the Swiss study reveals that income distribution in Switzerland has been very stable over the past century. Before tax, the richest 10% earn approximately one-third of total national income, a proportion which has not changed since the early 1930s. After government redistribution, this share goes down a few points to 30%, also a very stable figure.

(Graphic via The Swiss Inequality Database)

Melanie Häner, who heads the social policy branch of the Lucerne research institute IWP, says it is remarkable that inequalities in Switzerland are not bigger than they were 100 years ago, especially given the economic crises and wars over the past century.

In this regard, Switzerland represents an exception when compared with other countries, Häner told SwissInfo. The 2022 edition of the World Inequality Report, which came out in late April, said that since the 1980s “inequalities have got worse in most countries”. This negative trend has been “spectacular” in countries such as the United States, Russia and India, and more gradual in Europe and China. For example, the share of before-tax income held by the top 10% of wealthiest Americans rose from 34% in 1980 to 46% in 2022.

How the labor market limits inequality

Switzerland is one of the Western countries where the income divide is less obvious. This is especially true before redistribution, says Häner. After tax, the differences between Switzerland and its neighbors even out – redistribution is slightly less in Switzerland, but it is based on a lower level of inequality to begin with, adds Häner. The good health of the Swiss economy contributes decisively to limiting income disparities, explains Häner.

“The main factors are the flexible labor market – we have one of the lowest unemployment rates in the world – and the dual system of education and training, which enables people who don’t go to university to earn better salaries.”

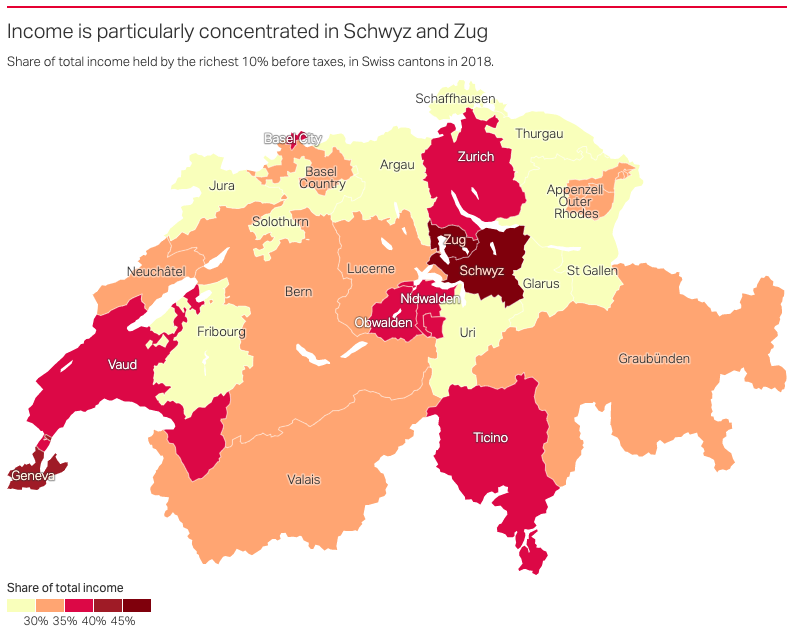

(Map via The Swiss Inequality Database)

The rich contribute

The richest 10% in Switzerland pay about 51% of all income tax in Switzerland, which represents a “substantial” amount which has hardly changed over 40 years, explains Häner.

She says tax competition between the 26 cantons – each is free to set its own tax rate – does not harm redistribution, because the very progressive federal tax counterbalances the low tax rates of some of the cantons, like Schwyz and Zug. These cantons “attract high earners thanks to their low cantonal tax rate, but these same people pay federal tax at a very high level”, she explains. The federal income tax scale starts off at 0.77% and goes up to 11.5% for the highest earners.

In addition, Switzerland has a national system of financial adjustment payments – solidarity between cantons, whereby the economically strongest help the weakest. Zug and Schwyz contribute most to the financial solidarity system – 2,600 CHF per Zug resident and just under 1,300 CHF in Schwyz.

Zürich may be home to the more famous banks, but the wealth lies to the south of the city.

Disparities in wealth are more marked

As mentioned above, income and wealth – measured by someone’s personal fortune or assets – are two different things. People with a high disposable income are not necessarily the ones with the biggest fortunes. If all of these elements of wealth are taken into account, is Switzerland really that egalitarian? For example, home ownership, at 40%, is the lowest in Europe. The constant rise in property prices tends to concentrate wealth in the hands of real estate owners.

In addition, lump-sum taxation (a special tax regime applied to foreign high-net-worth individuals domiciled in Switzerland), the lack of taxation on profits arising from sales of shares, and the low inheritance tax aid in this. Half of all personal wealth owned by Swiss residents comes from legacies, which are very unequally distributed.

According to the World Inequality Database, the richest 10% in Switzerland hold 63% of all capital, which has risen by almost six percentage points since 1995 when the last data became available. In Western Europe, only Ireland has a higher percentage (66%). The poorest half of the Swiss population only owns 4% of the nation’s wealth.

The increase in wealth inequality is something that can be seen all over the world.

“The increase in private wealth has continued in a very unequal manner, within countries and at a global level,” says the most recent World Inequality Report. The concentration of capital is more obvious in the U.S., where more than 70% of all wealth belongs to the richest 10% of the population. Between 1995 and 2020, this share rose from 41% to 68% in China, and 53% to 74% in Russia. While inequalities in Switzerland may be more pronounced than the European average, they are relatively moderate in comparison with the rest of the world.

يمكن مشاركة هذه المقالة وإعادة طباعتها مجاناً، شريطة أن تكون مرتبطة بشكل بارز بالمقالة الأصلية.