Do., Sep. 8th 2022

Switzerland has maintained its image as a tax haven for decades; but in today’s world, does this reputation still ring true?

Gorgeous nature, top tier health care and tax breaks — what’s not to like?

No matter what is in your checking account, moving to Switzerland will incur jokes among your friends about if you are doing it for the tax breaks. The land of cheese and chocolate has become synonymous with “tax haven” for good reason, but it is not a nickname Switzerland sought out. In fact, it was external forces that pushed the country to open its banks to the world; but, the Swiss have profited nicely from the move.

Switzerland’s extravagant Federal Palace in Bern was built shortly after the country’s banks opened its business to wealthy people across Europe — perhaps, not a coincidence.

The quick and dirty history

Following the fallout of the Franco-Prussian war in 1871, the French looked to safeguard their wealth from increased national taxation. They turned to their Swiss neighbors who were already offering private banking services within their borders. The French government decried the move, but the wealthy French pressed on. Under pressure, the Swiss federal government finally acquiesced and opened their private banks to outsiders.

Cantonal (regional) banks already competed for the business of locals; but, under the new low tax laws, cantons were able to entice more businesses to set up shop within Swiss borders. Moreover, the “Big Banks” – institutions such as Credit Suisse – began focusing on international wealth management and actively looking beyond their borders for clients. The broad outlines of this banking structure still remain in Switzerland to this day.

By the time World War I broke out in Europe, Swiss bankers had been managing the majority of Europe’s private wealth for nearly 50 years. And when World War II erupted, Europeans from nearly all socioeconomic groups knew where to safeguard their money. (Read more on how Switzerland justified banking with the Nazis during WWII).

It was during this period that much of Switzerland as we know it today was formed, from palatial hotels to state-of-the-art health services, to prestigious educational services. With all the infrastructure to back it up, Switzerland began promoting itself as a luxury tourism destination for wealthy pensioners.

Celebrities like Charlie Chaplin sought out Switzerland as an ideal destination to protect their wealth and live a life of privacy. In the years since Chaplin arrived in 1952, the country has continued to attract movie stars, musicians, artists, entrepreneurs and athletes, alike.

Credit Suisse has had a long, and sometimes checkered, history since it opened in 1856.

Where Switzerland stands today

During his 2021 State of the Union address, U.S. President Joe Biden went as far as to include Switzerland alongside Bermuda and the Cayman Islands as destinations helping companies evade their fiscal responsibilities. But in 2022, it was the U.S. that placed first on the Financial Secrecy Index and Switzerland, second. (Read more: Hiding your money? Don’t use Switzerland.)

Biden’s assertion prompted a swift rebuttal from the Swiss government, who deemed the statement outdated and confirmed their full compliance with all international tax standards. The speculation around Switzerland’s status highlights an important issue: the evolution of the term “tax haven.”

According to Daniel Bunn from the Tax Foundation, there are three broad classifications in terms of a “corporation tax haven”: The zero corporate tax countries (such as Bermuda and the Cayman Islands), the countries offering corporate tax allowance tax rates, and those countries rich in resources that apply resource relevant tax.

Bunn places Switzerland firmly within the second category alongside Ireland, Hungary and Bulgaria.

From both a corporate and individual standpoint, Switzerland has partnered with more than 100 countries in double taxation treaties. They have backed the OECD corporate tax reform deal to ensure a minimum taxation rate and they actively partake in Foreign Account Tax Compliance Act (FATCA) reporting.

The highest concentration of wealth in Switzerland is in Zug, pictured above.

How it works

Each Swiss canton decides how they would like to “welcome” wealthy foreigners. For example, there are several cantons (primarily in the French-speaking area) which offer an alternative to income-based taxes known as expenditure-based taxation. Some Swiss cantons have opted out entirely, and votes are regularly held on the matter to ensure that their laws represent the feelings of the residents. But even these restrictions have failed to make much of an impact and the numbers speak for themselves.

In 2018, 0.1% of taxpayers were taxed on this basis across the country, which translated to 4,557 people paying a total of CHF 821 million in taxes.

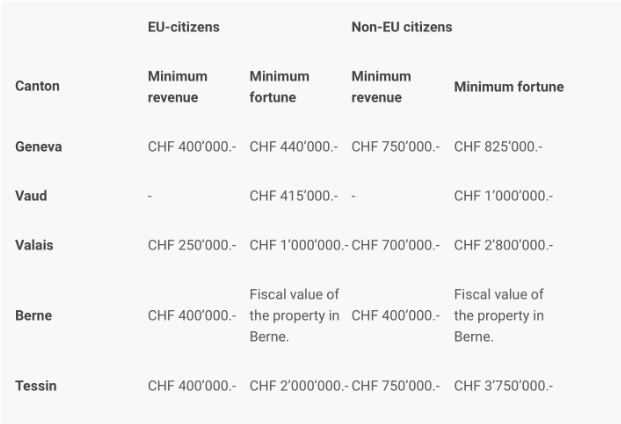

Expenditure-based taxation (more commonly known as lump-sum taxation), is a tax calculated on the total annual cost of worldwide living costs for the individual and their dependents. Each canton applies a minimum taxable base amount (as shown in the table below) and this amount remains subject to standard federal and cantonal income and wealth taxes.

In order to qualify for Switzerland’s tax breaks, a foreign national has to either move to Switzerland for the first time or move back after a ten-year absence from the country. This deal is exclusively for non-Swiss residents and rates vary according to EU/non-EU status. The individual cannot perform any gainful activities in Switzerland, including full-time or part-time employment.

For wealthy individuals considering Switzerland as a tax haven, the low tax rates and privacy laws continue to make it an appealing and legitimate option.

(Source: Legal Expat.)

Lump sum taxation offers an appealing and transparent tax outcome if their foreign income is significantly higher than the cost of living. While pop stars such as David Bowie, Shania Twain and Tina Turner all have made Switzerland home, more recently it has attracted top ranking athletes, like tennis players and Formula 1 drivers.

As the number 1 country in the world for expats, Switzerland looks set to maintain its appeal to the wealthy and fabulous for many years to come.

Dieser Artikel darf frei weitergegeben und nachgedruckt werden, vorausgesetzt, es wird auf den Originalartikel verwiesen.