Do., Mai 4th 2023

Switzerland’s House of Representatives this week passed a bill banning “too-big-to-fail” banks from handing out bonuses to top executives and certain managers.

The ban comes after the Swiss government announced the shotgun merger of Switzerland’s two biggest banks, UBS and Credit Suisse. Under the deal, UBS purchased CS for CHF3 billion with a state-backed guarantee of CHF9 billion and another CHF100 billion from the Swiss National Bank (SNB). CS was the first global systemic bank to almost collapse since the global recession in 2008.

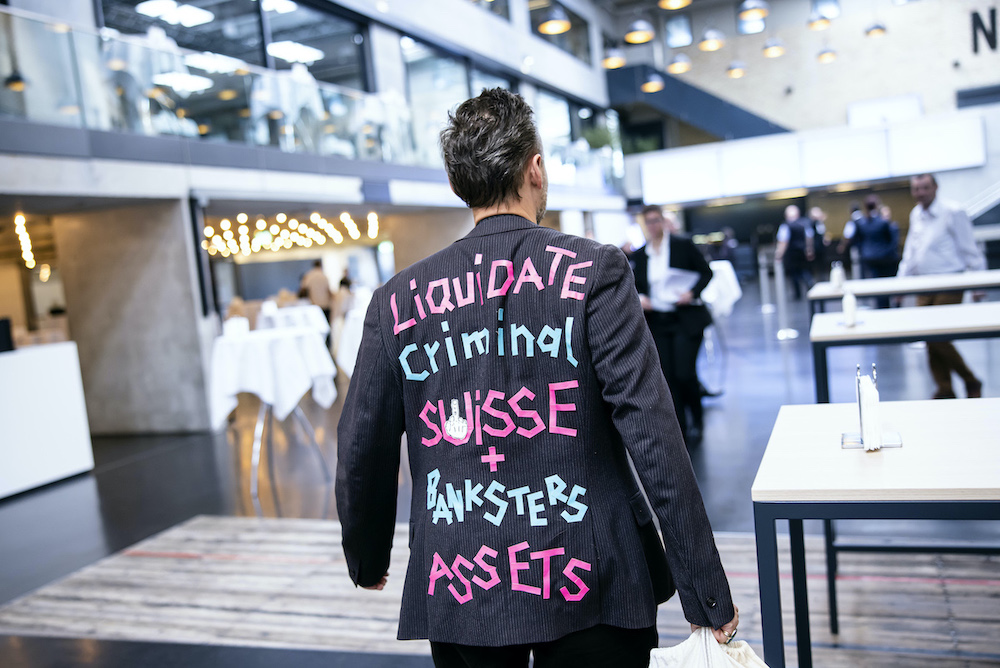

In the weeks following the announcement, thousands of Swiss people protested in the streets, politicians called for the merger to be undone and CS shareholders demanded executives return their bonuses. Former CS chairman Urs Rohner said in March that he would not return any of the CHF52 million he earned while working at the failed bank.

The Swiss government responded by announcing that all CS bonuses should be canceled, or at the very least reduced by 50% for the top three levels of its management.

Read more: Say bye-bye to bonuses

In April, Swiss Parliament held a special session to discuss the merger. The House of Representatives voted against the state guarantee; but so far, the vote has been purely symbolic as the Federal Council has not changed course.

This week the Social Democratic party (SP) proposed the “bonus ban” which would prevent systemically relevant banks from paying bonuses for risk managers and top executives. When it was put to a vote, 101 lawmakers voted for it and 70 voted against it. The proposal now goes to the Senate for approval. If approved, the ban will become law.

According to Prisca Birrer-Heimo (SP), who proposed the ban, the state guarantee on the merger means that any risk the bank takes on will ultimately fall to the Swiss taxpayers.

Such “systemically relevant” banks include PostFinance, Zuercher Kantonalbank, Raiffeisen Group, in addition to UBS and CS. Such banks are designated by the SNB as required to hold higher liquidity and capital cushions, as well as having emergency plans in place.

Dieser Artikel darf frei weitergegeben und nachgedruckt werden, vorausgesetzt, es wird auf den Originalartikel verwiesen.