Do., Dez. 1st 2022

For months, the U.S. government has been squeezing Switzerland over how it handles its Russian business ties. This week, the spotlight is on an alleged Russian shell company in canton Vaud that has reportedly circumvented war sanctions.

Die Schweiz hat letzte Woche ihre achte Runde von Sanktionen gegen Russland in Kraft gesetzt.

An electronics company in Switzerland is in hot water with the U.S. Office of Foreign Assets Control (OFAC) over its ties to Russia.

The company in question

According to OFAC officials, Milur SA in Epalinges acts as a Swiss electronic chip manufacturer, while it continues to foster ties to Russia’s armaments industry. How deep the relationship goes remains unknown to the public, but OFAC officials say Milur SA is acting as a Russian shell company.

Moreover, the U.S. government has put Milur SA’s trustee Alexander-Walter Studhalter and his associates on a watch list. For now, all Studhalter’s activities are being monitored, as well as those who have any connection with Milur or Studhalter.

As for the Swiss government, it froze all Milur SA’s assets during a round of Swiss sanctions on people and businesses with ties to Russia.

Shortly after Russia invaded Ukraine in February, the Alpine nation followed in the EU’s footsteps by freezing the assets of Russian oligarchs with known ties to Russian President Vladmir Putin. Switzerland then seized homes and restricted some Russian imports. Swiss banks froze all Russian accounts and Swiss businesses shut down their Russian branches. Switzerland banned all Russian gold to its refineries. Switzerland restricted all travel with Russia. And by summer, President Iganzio Cassis angekündigt that Switzerland would ban all imports, exports and services with the warring nation.

Last week Switzerland enacted its eighth round of sanctions on Russia by capping prices on Russian crude oil and petroleum. But for U.S. authorities, the country’s historical move away from traditional neutrality is simply not enough. (Read more: The war on Swiss neutrality).

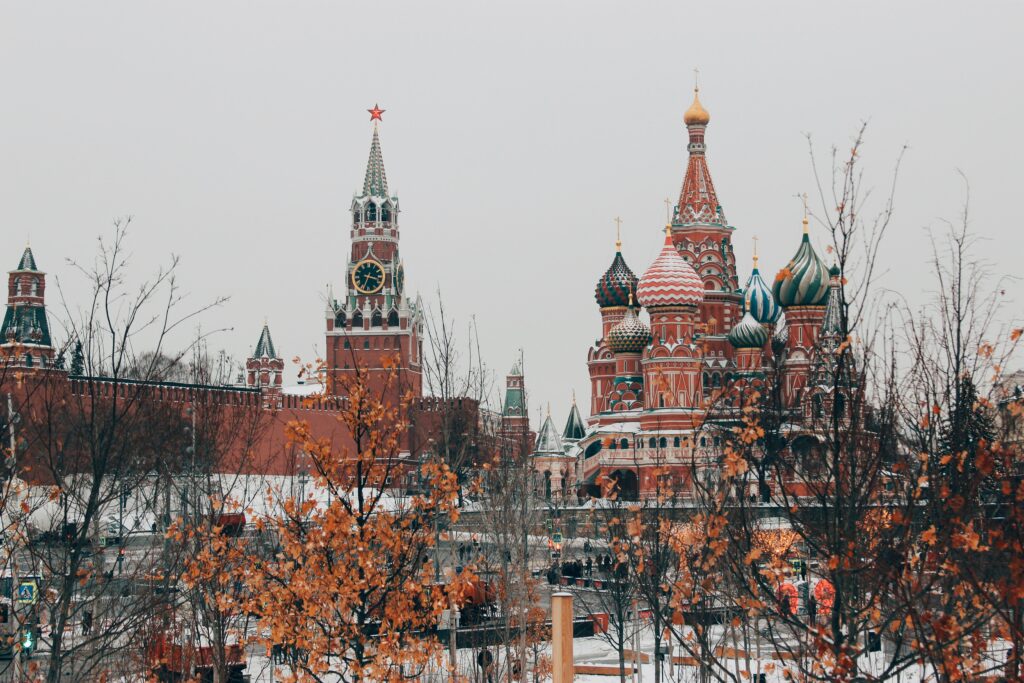

Inside Swiss Parliament, where the decisions on sanctions are made.

Months of surveillance

Earlier this year, the U.S. Commission for Security and Cooperation in Europe (a.k.a. The Helsinki Commission) accused Switzerland of being the “leading enabler of Russian dictator Vladimir Putin and his cronies” when it comes to hiding wealth. The Commission includes Swiss anti-corruption expert Mark Pieth and Bill Browder, a financier who claims that in 2013 Swiss prosecutors bungled a Russian money laundering case that involved the death of his Russian tax advisor, Sergei Magnitsky.

Known as the Magnitsky case, a Swiss prosecutor determined that millions of frozen Swiss francs rightly belonged to the Russian government and accused Browder of being a tax cheat. Afterward, Browder stated “there is something rotten in Switzerland.” In the years intervening, Browder also called for the U.S. to limit cooperation with Switzerland on issues of mutual legal assistance, a purely sovereign affair and frankly none of his business.

According to Bern newspaper Der Bund, Browder accused the Office of the Attorney General of Switzerland and the former head Michael Lauber of being in league with Russia. He called the Office “corrupt or absolutely incompetent,” adding that Switzerland is “known as a place for war criminals and kleptocrats.”

The reaction from the Swiss Federal Government has been quite strong.

Nach Angaben von Der Bund, Swiss parliamentarians are perplexed as to why the U.S. has a say in how neutral Switzerland functions during a time of war at all. According to the vice president of the Foreign Affairs Committee of the National Council, Hans-Peter Portmann (FDP): “what legitimacy does the Helsinki Commission” have? Furthermore, Portmann tells Der Bund that he suspects that a group of U.S. politicians is merely trying to assert its own economic interests and disparage the Swiss financial center.

For now, Milur SA’s financial movements will remain frozen, while Switzerland struggles to sort out what its future path for neutrality looks like.

Dieser Artikel darf frei weitergegeben und nachgedruckt werden, vorausgesetzt, es wird auf den Originalartikel verwiesen.