Articles connexes

16 mai 2024

UBS CEO Sergio Ermotti discusses the future size of UBS and regulatory changes at a Zurich event, emphasising the...

16 mai 2024

Switzerland extends AEOI coverage to crypto assets, enhancing financial transparency and regulatory compliance starting...

17 mai 2024

Swiss stocks are up as the Dow Jones Industrial Average surpasses 40,000 points, driven by renewed interest rate hopes....

14 mai 2024

Electric car adoption in Switzerland shows signs of stagnation, with slowing registration growth and diminishing...

14 mai 2024

Lidl Switzerland appoints Tobias Eggli as Head of Real Estate. With extensive experience, Eggli joins the executive...

15 mai 2024

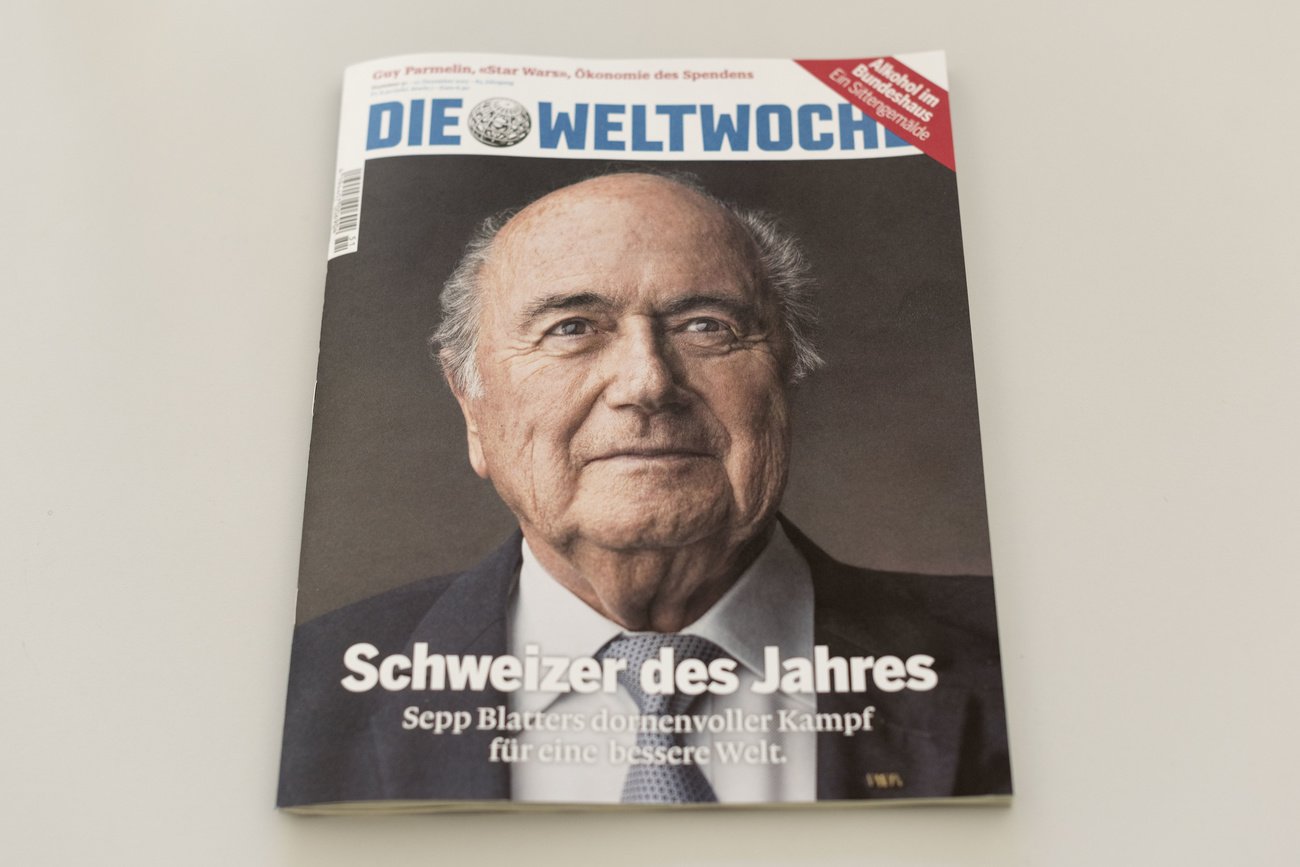

"Weltwoche" magazine removes content after Zurich judge's legal action against unauthorised recording during a court...

14 mai 2024

Organic farming gains ground in Switzerland, increasing its reach across farm units and agricultural land, despite a...