Tue, Apr 4th 2023

Two weeks after the announcement that UBS would purchase Credit Suisse (CS) in a government-backed shotgun merger without consulting shareholders, the leaders of the failed bank appeared in front of their bitter clients in their last, annual general meeting at Zurich’s Hallenstadion.

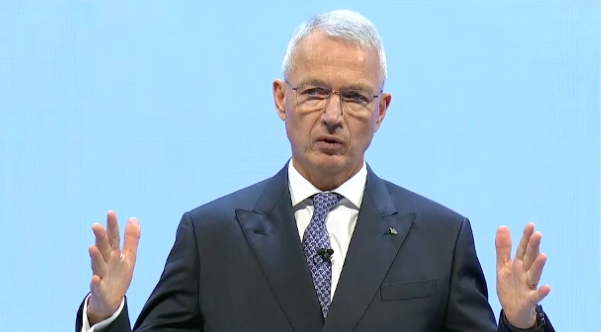

“This is a situation that no one could have anticipated…it’s a sad day for us and a sad day for you,” Axel Lehmann, CS chairman, said at the opening of the meeting. “I can understand the bitterness and shock and anger.”

Under the deal, UBS will buy Credit Suisse for CHF3 billion with Switzerland putting up a state guarantee on the merger totaling 260 billion Swiss francs, or about one-third of the country’s GDP.

While it is unclear how the new “monster bank” will function, Switzerland’s response to the merger has been one of outrage and anger. Hundreds of Swiss citizens, politicians and shareholders have protested the move by occupying the Paradeplatz square where both banks are headquartered in Zurich.

The shareholders who spoke at Tuesday’s five-hour long meeting were equally incensed.

“I didn’t bring my gun along this morning, don’t worry,” said one shareholder, citing the tight security to get into the meeting. In the course of berating the CS leadership, he cited the failure of Swiss federal councilors, specifically that Financial Minister Karin Keller-Sutter was “out of her depth.”

“I feel I have been completely cheated,” he finished to loud applause.

Another shareholder challenged Lehmann’s assertion that the bank fell apart in the week leading up to the merger, saying “numerous scandals in the past few years have thoroughly ruined the reputation of the bank and caused it to lose its clientele.”

Another shareholder pointed out CS’s investment failures with Greensill and Archego, as well as the kickback scandal involving the Mozambique government as sources of the bank’s downfall. These failures are “the reasons that staff took ever great risks and managed to circumvent the rules,” a shareholder asserted.

To be sure, CS endured years of plummeting stock, scandals, failed investments and bad headlines. CS made a last-ditch effort to rescue themselves by launching a radical restructuring in late October, 2022, but the bank ran out of time to right the ship. By February, CS announced it had lost 7.3 billion Swiss francs total in 2022.

“It’s a bitter reality that our strategy didn’t have time to bear fruit,” Lehmann said at the meeting, adding “there were only two options: make a deal or bankruptcy.”

A CS employee with 43 years at the company took the stage about an hour into the meeting, revealing that he wrote his concerns in a letter to the Lehmann in April 2022 and requested a special audit to be made.

“Now the employees are suffering all the implications” he said, noting the decades he spent building trust with his clients. The “trust was destroyed in one blow” and now employees’ “families are facing an insecure future.”

Another common source of shareholders’ anger was the bank’s changing culture — one that was focused more and more on making a profit, especially in concert with the U.S. market. Lehmann cited Silicon Valley Bank’s collapse as a main contributor to CS’s inability to gain its footing in March.

One shareholder pointed out the many recorded phone calls that occurred in the hours before the merger between the U.S., the U.K. and Switzerland’s financial minister.

“I don’t want Switzerland doing what the U.S. tells us to,” one shareholder said, adding that such behavior constitutes a satellite state.

“You were too busy helping rich Americans with tax evasion while the Swiss people suffered,” he said. “Our government cannot be like a dictatorship.”

A second shareholder called for the bank to be taken over by the Swiss people and run according to their interests. A third called for the board of directors to be put in jail and restricted from practicing banking in the future.

“There are Swiss pensioners who lost their whole pensions who may want to kill themselves…who will be held responsible for that?” he asked.

An economist from Lausanne suggested the newly-merged bank to implement a code of ethics that emphasizes the two “best Swiss values: honesty and integrity.”

“This was coming for 15 years and it could have been avoided had Credit Suisse employees put the values learned from their Swiss ancestors over making money,” she said. She offered up a new code of ethics to be handed off to newly-appointed UBS CEO Sergio Ermotti.

Meanwhile outside of the venue, protestors gathered with an overturned boat to represent the state of affairs in the Swiss banking world.

The shareholders voted Axel Lehmann and his board of directors to remain in their positions while the merger is completed. Lehmann received a 55% approval and gave his thanks to the audience.

For now, the newly-merged bank faces several obstacles, including an investigation from Swiss Federal Prosecutor Stefan Keller’s office, as well as a special parliamentary session next week to respond to public outcry.

Stay tuned.

This article may be freely shared and re-printed, provided that it prominently links back to the original article.