Mon, Mar 13th 2023

Since Russia invaded Ukraine a year ago, the Swiss federal government has mirrored nearly all the EU-imposed sanctions on Russia – from freezing assets and bank accounts to cutting off Russian businesses and exports. Local Swiss banks are required by law to report deposits of both sanctioned and non-sanctioned Russians who hold 100,000 CHF or more to the State Secretariat for Economic Affairs (SECO). SECO reported late last year that the sanctions have affected about 7,500 business relationships and a total of 46.1 billion CHF with connections to Russia.

“We were not just surprised but shocked that Switzerland abandoned its neutral status,” one board director who supervises Asian operations told the FT. “I have statistical evidence that literally hundreds of clients that were looking to open accounts are now not.”

While speaking with employees from six of Switzerland’s 10 biggest banks, the FT found a common theme: rich Chinese clients are apprehensive about their capital sitting in Swiss institutions if neutrality cannot be guaranteed. (Read more: Russian sanctions are the final nail in the coffin of Swiss neutrality)

In the last 20 years, Chinese clients and businesses have continued to strengthened the Swiss banking industry with large deposits. Notably, Chinese companies have been choosing Switzerland over the U.S. in the last two years amid rising tensions with the western nation. Nine Chinese companies in Zurich raised CHF3 billion in 2022 alone – far surpassing the $470 million they raised in the U.S., according to Dealogic data.

Although the Swiss government has never revealed Chinese assets in the country, a 2014 report from the International Consortium of Investigative Journalists divulged that Swiss banks had accounts for many of the Chinese elite, including the son of former premier Wen Jiabao. One bank employee said most Chinese clients tend to be smaller-scale entrepreneurs with accounts amounting to about CHF10 – 50 million. Still, losing these clients would be catastrophic to Swiss banks.

“Asia has been a strong contributor to profitability for Swiss banks,” RBC analyst Anke Reingen said. “If you look at their share prices, they are very closely correlated to Asian indexes because such a large part of earnings has been coming from the region and historically a large part of the earnings growth in wealth management.”

The Swiss banking sector accounts for about 10% of the country’s gross domestic product. Some employees said that their banks were already “war gaming” on how to endure the fallout should relations with China continue to worsen with rising sanctions against Russia.

“[Sanctions] was definitely a topic of concern with clients late last year. They were asking whether their money would be safe with us,” Reingen added.

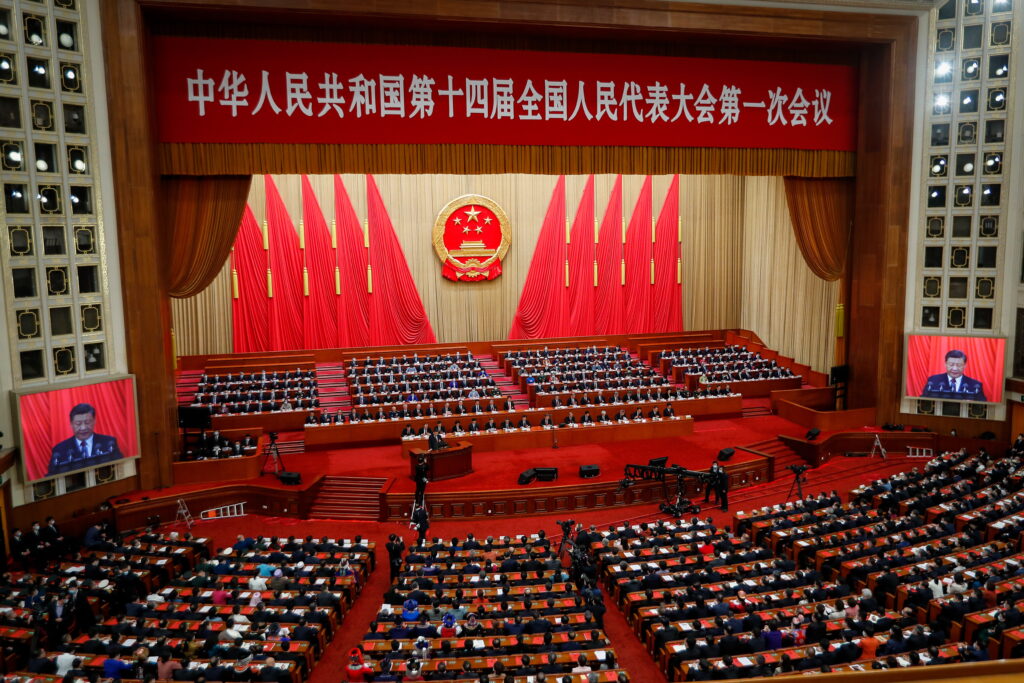

Diplomats from western countries have spoken of the possibility of sanctioning China in the last few weeks as the U.S. shot down apparent “spy balloons” from China and Beijing has considered supplying Moscow with war armaments. A U.S. diplomat in Bern said his office was “keeping a close eye” on Chinese bank accounts in Switzerland.

“It’s the topic high on the agenda at board and executive level,” Vontobel analyst Andreas Venditti said, adding that Swiss wealth managers were “all trying to prepare for what comes next.”

One Swiss bank executive said he believed his country had moved too quickly in mirroring EU sanctions against Russian citizens.

“At some place, we must draw a line on what [Switzerland] will and won’t get involved in,” he told the FT, adding that Switzerland should weigh the “credibility of Swiss neutrality” against Russia’s “violation of the fundamental norms of international law.”

Yet another bank executive says he is not worried at all.

“There was $700 billion of trade between China and the US last year; that’s not going to change any time soon,” he said.

This article may be freely shared and re-printed, provided that it prominently links back to the original article.